How To Save on Your Car Insurance Premiums

You drive a modest vehicle. You are safe on the road, always obeying traffic signals, staying within the speed limit, and allowing for a safe following distance. You have operated your car without major incident.

And yet, your car insurance rates are going up.

Again!

This is a familiar tale for American consumers, but there are ways to flip the script. There are methods to save money on car insurance. It requires a continued commitment to safety, paying attention to details, living in the right area, and avoiding complacency with your coverage.

Comparison Shopping

According to Consumerreports.org, average annual premiums for car insurance have risen across the nation by 23% since 2011. If your premiums continue to hike, it makes little sense to keep paying them without looking for a better option.

No matter what you’re buying it’s always a good idea to get a look at the competitor’s rates before handing over your wallet. To guarantee you get the best rates, you need to call up multiple car insurance providers.

You can even commission the help of an insurance agent to do some leg work for you. An independent insurance agent sells insurance policies for multiple insurance companies. He or she can weed through the various policies and highlight the ones that would save you the most money.

However, even with professional help, you may still miss out on some savings, since they will likely only be showing you the policies affiliated with their companies.

Regardless of whether you hire an agent or not, you should be seeking deals regularly. Sometimes, annual discounts of a few hundred dollars can be found.

Don’t be afraid to ditch your long-term insurance provider if it isn’t providing quality service at a competitive rate. However, too much activity may backfire.

“It’s fine to seek a better deal for yourself, but not every single year,’’ said Matt Caswell, an independent insurance agent in Dunedin, Florida.

“It will send up a flag that you’re not loyal. They will recognize that. A lot of times, if you’re with a good carrier, it’s not worth jumping in the long term just to save a small amount.’’

Insisting on Higher Deductibles

Instead of the common $250 or $500 deductible, ask for a $1,000 or $1,500 deductible that will lower your premiums.

“Always try to raise your deductibles,’’ Caswell said. “Chances are you’re not having accidents, or you haven’t had accidents. The money you save over the years will pay for that deductible (in an accident).

“You should never buy the cheapest deductibles because you’re afraid you’ll have an accident.”

Obviously, accidents do happen, so if you plan on raising your deductible, make sure you have enough money stashed away to cover costs in the event of one.

Some people prefer the idea of paying higher premiums, knowing it will cost them more money in the long run. They like the peace of mind of knowing they won’t have to go scrounging up funds if they get into a wreck.

Consider stashing away $1,000-$1,500 for the sole purpose of paying your deductible if the need arises. Then you can take advantage of lower premiums without worrying about an accident putting you in the red.

Combining with Home Insurance

Bundling your auto and home insurance can save you time and money, if done correctly. Discounts can range between 5%-25% off your premiums.

Bundling gives you the convenience of managing your insurance policies in one place. If something happens to damage both your home and car, like a major flood or storm, you can often file a single claim for both assets. You may even be able to get away with paying a single deductible. This is a lot easier than calling up multiple insurance companies to file multiple claims, on top of dealing with whatever caused you to file the claims in the first place.

However, don’t just assume you will save money with a bundle. One major downside to bundling is it may stop you from rate shopping. When an insurance company is dangling discounts in your face it can be hard to press the brakes on an immediate transaction. You want to take advantage of savings, but, in reality, the savings aren’t going anywhere. Most likely, they will still be there if you decide to return after exploring a few more options.

Location, Location, Location

Your zip code can reveal a lot about your risk factors, and this in turn will affect your rates. Car insurance companies don’t like the high population density found in major cities. This leads to congestion which leads to more accidents and more claims. This is why you will pay more for car insurance living in the city than in the suburbs.

The crime in your area won’t go unnoticed by insurance companies, either. If your neighborhood is prone to carjackings and vandalisms, your rates will spike. If your city’s roads are full of potholes, your rates will spike. If you live in an area known for harsh winters or severe environmental disasters, your rates will reflect it.

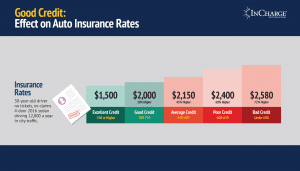

Improving Your Credit Score

Unless you live in Hawaii, California or Massachusetts your credit score will affect the rate of your insurance premiums.

A higher credit score indicates dependability and a decreased chance of filing a fraudulent insurance claim, qualities that are valued by all insurance carriers.

If you want to improve your credit score you need to keep up with your monthly payments. This is the most important factor when calculating your credit score and accounts for 35% of it. Even if you can only afford to make small payments on your debts, this can be enough to keep your credit score from crashing. A minimum payment is always better than no payment.

Also, don’t think it’s ok to max out your credit card just because you pay it back on time every month. You’re hurting your credit.

The amount you owe accounts for 30% of your credit score. When you max out your credit card every month, you’re signaling to the credit bureaus that you’re overextended and perhaps desperate for funds.

For the best credit score, never use more than 30% of your available credit limit on each of your credit cards, and don’t forget to monitor your credit report. You get a free one every 12 months from each of the bureaus. This means you can contact Experian, TransUnion, and Equifax and ask them each for a free copy of your credit report. You can order them all at once to compare, or you can spread them out for a free check every few months.

Be a Safe Driver

Car insurance companies offer safe driver discounts that can cut the cost of premiums.

The more moving violations you rack up, the higher your premiums will climb. A moving violation is any law broken by the driver of a vehicle while it is in motion. Dashing through a red light, ignoring stop signs, and driving under the influence are all considered moving violations.

Parking violations won’t raise your rates so if you get a parking ticket you don’t need to worry about smoothing things out with your insurance provider. Equipment violations i.e. busted taillight or missing review mirror, won’t raise your rates either.

The amount you can save varies from company to company, but generally speaking, longer periods without moving violations lead to larger savings.

Ask About Additional Discounts

Ask about any other discounts you may be eligible for. It shouldn’t take long to run your background and see if you qualify. Certain discounts may require documentation before being put into effect, like a report card or picture of the odometer.

Here’s a list of some car insurance discounts that can save you money:

- Affiliation Discount: Car insurance companies may offer discounts through your employer, school or club.

- Anti-Theft Discount: Having the latest in anti-theft technology lowers your risk and car insurance companies often offer discounts because of this.

- Good Student Discount: Having a good GPA, generally 3.0 or above, may put you in line for a generous discount.

- Customer loyalty: Some insurance companies like to reward long-term customers by slashing their rates after the first year.

- Multi-Car Discount: If you’re insuring multiple vehicles your insurance provider may be willing to cut a deal on your monthly rate.

- Low-Mileage: If you have a short commute or only use your car for rare outings, you could be eligible for a low mileage discount.

Why Auto Insurance Premiums Go Up

Car insurance premiums aren’t simply rising, they’re skyrocketing. The average annual premium has risen by over 20% since 2011.

Your auto insurance premiums are going up because it’s getting more and more expensive to cover you.

There are a lot of factors at work when calculating the rate of your premiums. Insurance is meant to cover the costs of mishaps. It pays for hospital stays, which are more expensive than ever. The average cost of a hospital stay has risen by 10% since 2010 and sits at around $10,700.

If you’re in the hospital after an accident, your car’s probably not in the best shape, either. Insurance companies have to replace wrecked cars, and the cars coming out today are more expensive to replace than the ones we were driving 10-20 years ago.

Another factor that’s exacerbating the two above: distracted driving is on the rise. We can’t seem to stop peeking at our smartphones even while veering down the freeway. According to the National Highway Safety Administration (NHTSA), texting is the most alarming distraction:

“Sending or reading a text takes your eyes off the road for 5 seconds,” Caswell said. “At 55 mph, that’s like driving the length of an entire football field with your eyes closed.”

Distracted driving leads to more accidents, which leads to more claims. The more claims filed in your area, the more you will pay for car insurance.

Lower Car Insurance for Teenage Drivers

Insuring a teen of either gender means an average annual increase of 79% to your car insurance premium. But for boys? That’s a whopping 92% increase!

Still, Caswell said there are a few measures that could decrease the sticker shock.

- Good Student Discount: Most carriers reward academically sound teenagers. A 3.0 GPA could get you a discount of up to 25% off your premiums.

- More Education: Accordingly, students who take driver’s education classes or attend driving school will have a chance at discounts. It’s all about the effort toward accident prevention.

- Sorry, Sport: If you have a teenage son who’s the adventurous type, no doubt he has his eye on a souped-up sports car or a jacked-up truck. Do not buy him one! In addition to the fact that those vehicles are exorbitant investments, when it comes to insurance, giving those high-level keys to your teenager is like placing a “Kick Me’’ sign on the seat of your trousers.

Many parents will tell their kids to get a job if they want to buy, let alone insure, a car. That’s not a bad idea, but don’t let the high price of insuring a teen daunt you. The strategies above can help shrink down the costs to something reasonable.

Balancing your budget can help shave down costs even more. It will help to know where your money comes from and where it’s going every month. This may seem like intuitive knowledge, but it’s not. The results will surprise and maybe even confound you.

Consider nonprofit credit counseling as a way to help you establish a clearer picture of your finances. A credit counselor will help you balance your budget and can answer some questions you may have about debt consolidation or how to save money.

Sources:

- Stranger, T. (2019, September 26) The Smart Way to Save On Car Insurance. Retrieved from https://www.consumerreports.org/car-insurance/the-smart-way-to-save-on-car-insurance/

- Howard, P. (2019, October 25) Bundling home and auto insurance policies. Retrieved from https://www.policygenius.com/homeowners-insurance/bundling-home-and-auto-insurance/

- Gusner, P. (2018, June 29) 13 things that affect your car insurance. Retrieved from https://www.insure.com/car-insurance/car-insurance-factors.html