Benefits of Good Credit & What You Can Do With It

Your credit, good or bad, can have an impact on almost every aspect of your life, from having a roof over your head to getting a job.

Your credit, good or bad, can have an impact on almost every aspect of your life, from having a roof over your head to getting a job.

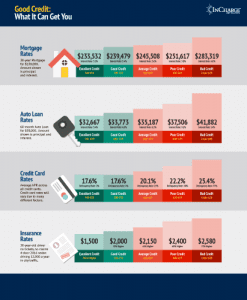

What can good credit get you? You may be able to save thousands on your mortgage, auto loan, credit card rates and auto insurance. You’ll have more money in your pocket, which you then could use for investments or savings to make even more money.

What harm does bad credit do? It costs you in the form of higher borrowing rates, may keep you from buying the house or car you want, and may even keep you from getting the job you want. Debt and your security clearance don’t mix. If you have excessive debt, you may have trouble keeping or getting a security clearance.

“Having good credit is really about access,” said Lauren Bringle Jackson, an accredited financial counselor and content manager at Self.inc. “The better your credit, the more options you have when it comes to getting credit cards, loans, etc. You can shop around and choose what works best for you, rather than just taking whatever you can get.

“Bad credit limits your options, and usually costs you more money because you get charged higher interest rates or have to make bigger down payments to cover the risk your bad credit poses to lenders.”

Changing bad credit, boosting average credit and maintaining good credit are the absolute most important things you can do for your financial health.

Does Your Credit Score Impact Your Life?

Understand your credit score, how it impacts your life and what you can do to help raise it.

What Is a Credit Score Used For?

The heart of your credit standing is your credit score, and establishing a good credit score packs quite a financial punch. You can bank anywhere from thousands of dollars to hundreds of thousands of dollars by raising your score and opening the door on many financial opportunities.

“Improving your credit score enough so you get a 1% better rate on your mortgage saves thousands over the life of the mortgage,” Anna Lusardi, professor of economics at George Washington University, said. “Knowing your credit scores – and how to improve it – is one of the most important things you can do to improve your financial life.”

Credit scores on both the FICO and Vantage scale are between 300 and 850. With FICO, anything above 740 is excellent, less than 580 poor. Vantage is about the same: Excellent is above 780, poor below 600. In 2020, the average FICO score nationwide increased seven points to 710, the highest since scores were tracked. Homeowners who took out mortgages in the fourth quarter of 2020 had a median credit score of 786, according to the Federal Reserve Bank of New York.

Someone in the poor credit score category often will pay 50% or more to borrow the same amount of money as someone in the excellent category. But those consequences extend beyond borrowing money.

Good Credit Means More Options to Buy or Rent

One of the biggest things your credit score will affect is the roof over your head. And that’s not just limited to mortgages — renters, too, will feel the sting if they have bad credit.

The National Association of Realtors says that the average consumer will buy between three and four homes during a lifetime. The cost of getting started has gone up steadily, so having a good credit score is crucial, no matter whether it’s your first or fourth home.

The higher your credit score, the better your interest rate for a mortgage.

Paying Less for the Same Mortgage

The average homebuyer, with a good credit score – somewhere above 700 – will pay thousands (maybe tens of thousands) less over the life of a 30-year mortgage than someone with a credit score of 620 or under. A credit score of 730 to 760 is required to get the best rates on loans.

Someone with an excellent credit score, say above 760, qualifies for a 3.2% interest rate on a $200,000 mortgage, has a payment of $865 per month and pays $111,376 in interest over 30 years. Her neighbor, with a 620 credit score, considered the drop-off point in the mortgage industry, borrows the same amount, but his interest is 4.8%, so his payment is $1,048 per month with a total interest charge of $177,579 in interest over the life of the mortgage. (Figures courtesy of the U.S. Securities and Exchange Commission’s Compound Interest Calculator).

The out-of-pocket cost to the borrower with poor credit: $179 per month. Which is where something called “opportunity cost” figures. That cost measures the lost opportunities because of the extra payment. If the woman with better credit invested $100 of the $179 savings each month and made just 5% on the investments (a conservative figure), she’d had earned another $80,158 over 30 years, money that could be used for retirement or college expenses for the children. If she invests all $179 of that monthly savings, she’d have $143,484 to her name.

The neighbor with poor credit misses a great opportunity to help himself and/or his family.

“Credit scores are a huge factor in determining the risk a lender is willing to take,” Fred Kreger, president of the Association of Mortgage Professionals, said. “We want to give you the best rate we can because we want repeat customers. If I’m essentially going to write you a check to buy a home, I need to be able to trust you. Credit scores help me build that trust.”

No-Hassle Renting

There are few statistics on how many landlords require credit scores, or what score they require, since, unlike mortgages, those figures aren’t compiled. Many landlords do require credit scores, particularly in large urban areas. The best rule of thumb is to assume your credit will be checked before you sign a lease.

According to The Mortgage Reports, less expensive rentals generally require a score of at least 600 to 620. More expensive apartments can require a score of 740 or higher. Many landlords will require those with low scores make extra deposits, guarantors, or pay extra months of rent in advance. A study of more than 5 million rental applications by RENTcafe showed that the average U.S. renter’s credit score was 638 in 2020 – a number that increased by one point in each of the last three years.

While a higher score doesn’t mean a lower rent, it does mean a better apartment, and possibly fewer extra fees from the landlord.

“Many landlords use credit checks to filter out prospective candidates,” Logan Allec, a CPA, personal finance expert, and owner of personal finance blog Money Done Right, said. “This is even more common when being evaluated for a more expensive property. Your bad credit could separate you from the place of your dreams, even if you’re a perfect candidate otherwise. “

Save Money on Utilities

A good score also means that renters and homebuyers, who must pay utilities, can save money by not paying a security deposit on utilities, such as gas, electric and water. Those with poor credit may also have to pay on delivery for heating fuel or other utilities, rather than being billed.

Better Car Loan Rates

The COVID-19 pandemic hit the auto industry in 2020, but not as badly as initially feared. Total car and light trucks sales were about 14.6 million in the United States in 2020, down 14.6% from the previous year. That’s not ideal, but with plant shutdowns hitting the industry, the decrease from 17.1 million in 2019 could have been worse.

The challenge continues in 2021, as companies are having a hard time obtaining the chips needed to run circuits in cars and trucks. General Motors idled four North America plants for four months this year and has decreased its expected pretax 2021 by between $1.5 and $2 billion. Ford said it could reduce second quarter production by one-half.

That does not mean the price of cars is coming down. Analysts at Kelley Blue Book reported that the estimated price for a light vehicle in the United States was $38,723 in 2020. New vehicle prices jumped $940 year-over-year. Car loan debt totaled $1.37 trillion. That is 9.5% of all consumer debt; the average monthly cost is $550.

A strong credit score can help. According to U.S. News and World Report, the interest rate on an auto loan can range from 2.5% for a borrower with a credit score of 700 or more to 6.76% for those between 450 and 599. That’s a difference of thousands of dollars based on the credit score.

Rates are somewhat higher if you’re buying a used car, ranging from 2.74% for the best credit scores, to 7.01% for the not-so-good scores.

Lower Credit Card Interest and Higher Limit Approval

Credit scores that are considered average or poor by mortgage and auto loan standards are still considered good enough to get a credit card. But you pay for it. The average credit card interest rate in June of 2021 was 16.13%, according to CreditCard.com’s Weekly Credit Card Rate Report. Consumers with a credit card balance have an average FICO score of 736, according to Experian’s 2020 Consumer Credit Review.

Some 70% of Americans have at least one credit card, with 34% carrying three or more cards. The American Bankers Association reported that at the end of 2020 there were 365 million open credit card accounts in the United States. The average debt on those cards: $6,200.

The lower the credit score, the higher the amount of interest on that balance. The higher the score, the lower the interest as well as more lenient repayment plans and high credit limits.

Better Insurance Rates

Insurance rates are based on risk and probability, so it shouldn’t be a surprise that your credit score will have an impact on your premium.

More specifically, insurers determine rates using an insurance score, which is based on the same model as a FICO credit score. The insurance score uses some of the same criteria, but is designed to calculate how likely you will be to make a claim, rather than simply how faithfully you pay your bills.

About 95% of auto insurers and 85% of home insurers in 47 states use a credit-based insurance score when calculating risk. The exceptions are Massachusetts, Hawaii, California, Maryland, Michigan, Oregon and Utah, where using credit history to calculate insurance premiums is against the law.

In states where credit scores are used, the difference in rates is nearly double between good scores and poor – from an average of $1,508 per month to $2,904. A very good credit score could reduce rates by as much as 24% when compared to average credit.

The formula the insurance industry uses isn’t public, but the credit check is less extensive than a “normal” credit check. Your insurance score is a calculation of some of the factors in your credit history.

Your credit score could have more of an impact on your auto or home premium price than any other factor, Consumer Reports says.

Your Credit Score and Employment

A bad credit score may keep you from getting a job, especially in the financial industry. Companies look for dependable, trustworthy employees and might view a poor credit score as an indication that an individual isn’t responsible.

A study by Career Builder found that 29% of employers who do background checks, include credit checks. Employers must get the applicant’s permission to check a credit score, and you don’t have to grant it, but not doing so probably won’t help your chances of getting hired.

“Having a good credit history boosts your credibility and trustworthiness to an employer before you walk in the door,” Allec, the personal finance expert, said.

If you plan on starting your own business, you still can’t avoid the impact of a bad credit score. To get your business off the ground, you may need a business loan from a bank, and bad credit won’t help.

Chad Pavel, a CPA and founder of Pinewood Consulting LLC, a New York-based firm serving entrepreneurs and investors, said bad credit can hurt your business in more ways than one.

“When you own a business, the number one thing on your mind each day will likely be cash flow,” he said. “If you have poor credit and you need funding for your business, you can experience stress in a number of ways.” He said that could include lower credit lines, higher interest rates and more scrutiny over your financials by potential lenders.

Consequences of Bad Credit and How to Repair Your Credit Score

Experian reports that 11.1% of Americans have a credit score below 550 – which is just more than 12 million of us. The exceptional group – above 800 – numbers 69.3 million. The same number have a good credit score.

So while we’re generally trending positively, the difference makes a big difference. Someone in the poor credit score category often will pay 50% or more to borrow the same amount of money as someone in the excellent category. That’s if they qualify. It’s what makes getting out of debt with bad credit such a difficult task. Many individuals with poor credit won’t qualify for loans and those that do will have to pay more for it.

“Bar none, credit scores are the most influential factor in getting competitively priced credit,” said credit expert John Ulzheimer, a former employee at Equifax. “If you’ve got solid scores – 750 or higher – lenders will be falling over themselves to offer you great deals on loans and credit card products. If you have lower scores, it means fewer and more expensive options.”

Bad Scores Can Be Fixed

A bad credit score won’t haunt you for life. A FICO insurance score is a “snapshot” of insurance risk at a particular point in time, the credit-scoring firm points out. The score changes as new information is added to your credit bureau files.

Scores also change gradually as you change the way you handle your credit obligation. Insurers, credit card companies and other lenders request the most current score when a new application is submitted, and by taking time to improve your credit score, you can qualify for better rates.

Managing Debt Is Best Step

Bad credit is directly linked to debt — how much you have and how you pay it.

Paying down credit cards, paying bills on time and reducing your debt to income ratio are the best – and fastest – ways to improve your credit.

If doing that seems overwhelming, it may be time to consider credit counseling. Nonprofit credit counselors can review your finances for free and recommend solutions. They may suggest a debt management plan, which can lower credit card interest rates and combine payments into one lower monthly bill. Making an affordable once-a-month payment will have a positive long-term effect on your credit score, because your payments will be on time and your debt load will be reduced.

Dealing with debt issues is the quickest way to increase your income through lower payments for interest, insurance and more. It’s the best path to being able to afford an apartment or house, and overall financial health.

Sources:

- Lembo Stolba, S. (2019, September 6) What is the Average Credit Score in the U.S.? Retrieved from https://www.experian.com/blogs/ask-experian/what-is-the-average-credit-score-in-the-u-s/

- Warden, P (2018, March 19) What credit score do you need to rent an apartment? Retrieved from https://themortgagereports.com/36617/what-credit-score-do-you-need-to-rent-an-apartmenthttps://www.apartmenttherapy.com/credit-score-to-rent-an-apartment-266377

- Wagner, I (2020, January 9) U.S. Car Sales from 1951 to 2019. Retrieved from https://www.statista.com/statistics/199974/us-car-sales-since-1951/

- N.A. (2020, January 3) Average New Car Prices up 2% year over year. Retrieved from https://mediaroom.kbb.com/2020-01-03-Average-New-Vehicle-Prices-Up-Nearly-2-Year-Over-Year-in-December-2019-According-to-Kelley-Blue-Book

- Thatham, M. (2020, January 13) 2019 Consumer Credit Review. Retrieved from https://www.experian.com/blogs/ask-experian/consumer-credit-review/

- N.A. (ND) Your credit score doesn’t affect your rate: partially debunking a car Insurance myths. Retrieved from https://www.esurance.com/info/car/myth-your-credit-score-doesnt-affect-your-insurance-rate

- N.A. (ND) About Insurance Scores. Retrieved from https://insurancescores.fico.com/aboutscores

- Deaton, J.P. and Parsons, N. (2021, February 3) Average Auto Loan Rates in February 2021. Retrieved from https://cars.usnews.com/cars-trucks/average-auto-loan-interest-rates

- Chapkanovska, E. (2021, May 19) 19+ Credit Score Statistics for an Awesome FICO in 2021. Retrieved from https://spendmenot.com/blog/credit-score-statistics/

- Gravier, E. (2020, August 27) Can employers see your credit score? How to prepare for what they actually see when they run a credit check. Retrieved from https://www.cnbc.com/select/can-employers-see-your-credit-score/

- Stolba, S.L. (2021, April 12) U.S. Auto Debt Grows to Record High Despite Pandemic. Retrieved from: https://www.experian.com/blogs/ask-experian/research/auto-loan-debt-study/