How the “Sandwich Generation” Manages Raising Kids While Caring for Elderly Parents

American culture has created names for various age groups based on when they were born. Baby Boomers. Millennials. Generations X and Y. But another demographic has emerged based on what’s happened before and after them.

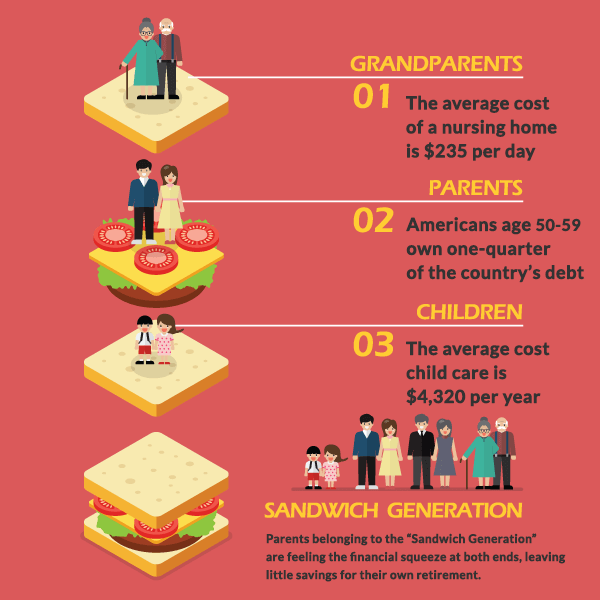

It’s called the Sandwich Generation.

The people in the Sandwich Generation are having to look after aging parents at the same time they’re raising children not old enough to be on their own. The Pew Research Center determined in 2012 that 47% of Americans in their 40s and 50s have elderly parents while still supporting their children, and 15% are caring for both.

The finances between these two slices can get spread awfully thin. Borrowers ages 45-54 have the nation’s highest average credit card debt. There are a lot of reasons people charge things, but the need to care for themselves and two other generations of family members cannot be discounted.

Since earning more money isn’t always possible and borrowing more money isn’t always wise, there are some other avenues to consider in dealing with this dilemma.

Tax Credit for Child and Dependent Care

Paying less in taxes is the next best thing to a salary bump. The federal tax code has the Child and Dependent Care Tax Credit to help if you paid someone to care for your child. The credit also is available if you paid for the care of a spouse or a dependent of any age who is unable to care for themselves.

To qualify, the adults must be working or unable to care for their dependent children, who in most cases must be younger than 13. The daycare center must be a qualifying provider; you can’t pay older children to babysit them.

This can be worth up to $3,000 for one child and up to $6,000 for multiple dependents, but there is a sliding scale based on income that will determine what percentage of these costs are credited on your taxes. If your income allows for a 30% credit and you spent $4,000 on child care, your tax credit would be $1,200. And this is a credit, which is better than a deduction. It directly reduces the amount of tax you owe for the year.

Allowable expenses include a daycare center, babysitter, summer camp or other care provider whose services allow you to work or look for work. Check with www.irs.gov.

Caring for Elderly Parents

There’s no getting around it: Nursing homes are expensive. In 2018, the average cost for a shared nursing home room was $235 per day. That rate fluctuates based on where you live. Oklahoma ($147) has the lowest daily rate; Connecticut ($412) is the highest in the Lower 48 states. Nursing homes are among the most expensive forms of elder care, so finding acceptable alternatives is important.

Sometimes, however, there’s no substitute for a nursing home. In addition to relocating to a part of the country where costs are lower, there are ways those who need it can defray some of the expenses so they don’t fall heavily on the Sandwich Generation.

Medicare offers limited help. For those using a nursing home for convalescence, Medicare will pay for 20 days of care at 100% of the cost. For the next 80 days, Medicare will pay 80% of the cost. If you have it, Medicare Supplemental Insurance will pay the remaining 20% of the cost for the last 80 days of coverage. Neither Medicare nor Medicare Supplemental Insurance will pay for nursing home care after that.

Medicaid, through its state affiliates, will pay for 100% of nursing home costs at a Medicaid approved nursing home. Qualifying, however, means that the person’s income and financial assets must be low. In 2018, the monthly income couldn’t be above $2,250, and the value of their financial resources (except for a home or other resources used by a spouse) not more than $2,000. Military veterans have access to benefits to defray nursing home costs. Also, nursing home care is tax deductible by using the Medical and Dental Expense Tax Credit.

If the spouse still lives at home, a reverse mortgage can be used to pay for nursing home care. A reverse mortgage is a loan taken against the value of the home. The loan does not have to be paid back until the last borrower dies or moves from the home for a full year. This can, however, affect Supplemental Security Income, Medicaid and veterans’ pensions by pushing the family’s financial resources over allowable limits.

Nursing Home Alternatives

States have Medicaid waivers – known as HCBS Waivers, 1915 Waivers or Home and Community Based Services, Medicaid waivers — that allow people who medically qualify for nursing home care to get that care at home, less expensively. They usually have the same eligibility requirements as the state’s institutional Medicaid plan. Most states also have non-Medicaid funded programs for those who require nursing home-level care but are not eligible for Medicaid.

As well, consider whether nursing home care is necessary. Many assisted living communities now offer a high level of advanced care services, but, on average, they cost about half as much. Some of the factors that make nursing homes preferable are whether the residents need skilled nursing care and extensive personal care and daily medical care, and if they are not mobile without assistance and have severe cognitive impairments. Assisted living facilities typically have more extensive recreation activities.

Medicaid actually has a program that assists those in nursing homes move back into their communities. Called the Money Follows the Person (MFP) Program, it is available in 43 states and the District of Columbia. MFP doesn’t provided grants to individuals, but supports state programs that help nursing home residents move back home or into the home of a loved-one. To be eligible, one must be a current nursing home resident who has have been there for at least 90 consecutive days and be enrolled in a state Medicaid program. Money may be allocated to modify homes to increase the participant’s independence and safety, such as stair lifts, wheelchair ramps and bathroom safety modifications.

Childcare and College Tuition

At the other end of the Sandwich Generation spectrum are the children, both the very young and those in college. Assuming all of the adults in the family are employed, child care is a necessity. Costs vary by region, but a 2016 study calculated the median child care price for a family with a preschool-age child is $4,320 per year. Naturally, those with higher incomes have the option to choose more expensive facilities; families making $50,000 to $60,000 per year might spend closer to $6,000 — less than more affluent families, but a greater percentage of their income, too.

If your workplace has on-site child care, that can be a money-saver. If not, try negotiating a flexible work schedule with your employer(s) so that you and your partner can stagger your work days to reduce the amount of time the child spends in a day care facility. Some parents get together to organize their own grassroots preschool. On the more highly organized end, they might hire a teacher trained in early childhood education; on the more informal end, hiring less experienced day-care providers who would not be as expensive. For lower-income families, Head Start is an alternative.

College requires a different set of calculations. Colleges costs vary widely, from elite private institutions where tuition and fees average $34,740 to state colleges (average $9,970) and community colleges ($3,347).

Students dream of going to a certain university, which is fine, but the family needs to take a clear-eyed look at whether the costs outweigh the benefits. There are 43 million Americans stuck with debt because they’re in careers that don’t pay enough to make pay off their student loans.

The federal government and most colleges provide some sort of financial aid. In determining how much aid they will offer, they calculate the expected family contribution (EFC), which measures the family’s financial strength: how much money your family has, how big your family is and how many people in your family are in college. The Free Application for Federal Student Aid (FAFSA) is the place to start.

Planning for Retirement

In helping the older and younger family members, those in the Sandwich Generation are finding it difficult to plan for retirement. Of Generation X (born between 1965 to the late ‘70s), 37% fear they will not be able to retire, according to a survey from TD Ameritrade. Almost half (49%) say they worry about running out of money in retirement, and 17% say they aren’t saving or investing.

There is no magic bullet for this problem. If the Sandwich Generation doesn’t contribute to its 401(k) retirement accounts – even if that means foregoing some enjoyable activities – it’s children are going to be in the same unpleasant bind it faces now.

7 MINUTE READ

Home » InCharge Blog »

Sources:

- Tanzi, A. (2019, March 5). U.S. Credit Card Debt Closed 2018 at a Record $870 Billion. Retrieved from https://www.bloomberg.com/news/articles/2019-03-05/u-s-credit-card-debt-closed-2018-at-a-record-870-billion

- NA, ND. Deducting Summer Camps and Daycare with the Child and Dependent Care Credit. Retrieved from https://turbotax.intuit.com/tax-tips/family/deducting-summer-camps-and-daycare-with-the-child-and-dependent-care-credit/L8aAzvmjB

- NA, (2018, May). How to Pay for Nursing Home Care / Convalescent Care. Retrieved from https://www.payingforseniorcare.com/longtermcare/paying-for-nursing-homes.html

- NA, (2017, October 10). Costs of Care. Retrieved from https://longtermcare.acl.gov/costs-how-to-pay/costs-of-care.html

- Whitehurst, G. (2018, April 19). What is the market price of daycare and preschool? Retrieved from https://www.brookings.edu/research/what-is-the-market-price-of-daycare-and-preschool/

- NA, ND. The Expected Family Contribution (EFC): FAQs. Retrieved from https://bigfuture.collegeboard.org/pay-for-college/paying-your-share/the-expected-family-contribution-efc-faqs

- Shell, A. (2018, January 10). Retirement crisis: 37% of Gen X say they won't be able to afford to retire. Retrieved from https://www.usatoday.com/story/money/2018/01/10/retirement-crisis-37-gen-x-say-they-wont-able-afford-retire/1016739001/

- Taylor, P.; Parker, K.; Patten, E.; and Motel, S. (2013, January 30). The Sandwich Generation Rising Financial Burdens for Middle-Aged Americans Retrieved from https://www.pewresearch.org/wp-content/uploads/sites/3/2013/01/Sandwich_Generation_Report_FINAL_1-29.pdf

- NA, (2016, May). Comparing Assisted Living and Nursing Home Care. Retrieved from https://www.payingforseniorcare.com/assisted-living-vs-nursing-homes.html

- Wallace, K. (2017, March 30). Ways to Make Child Care More Affordable. Retrieved from https://www.morningstar.com/articles/800381/ways-to-make-child-care-more-affordable.html

- NA, ND. Child and Dependent Care Tax Credit. Retrieved from https://americantaxservice.org/child-dependent-care-tax-credit/

- NA, ND. Child and Dependent Care Information. Retrieved from https://www.irs.gov/credits-deductions/individuals/child-and-dependent-care-information