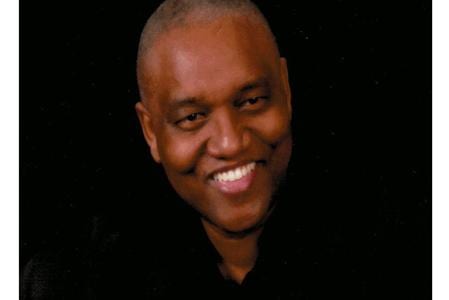

Reginal Sconiers Celebrates 10 Years as a Credit Counselor

Reginal Sconiers hears voices every afternoon.

“I’d say somewhere between 10 and 15 every day,” he said.

They are the voices of concern, voices of distress, voices of anxiety driven by debt from credit cards, student loans, medical bills and other financial choices gone wrong.

“It’s people who are disappointed in their financial situation and disappointed they let it get that way,” Sconiers said. “You can hear the disappointment in their voices.”

Sconiers is a <a href=”https://staging.incharge.org/credit-counseling”>credit counselor</a> at <a href=”https://staging.incharge.org”>InCharge Debt Solutions</a>. It’s his job to listen while people recount their financial problems and determine if a debt management program or some other service will ease their anxiety.

“It’s my job to find a solution to the problem,” Sconiers said. “I want something that works for them and gives them hope of finding a way out.”

Sconiers came to InCharge 10 years ago, after spending 30 years as a cook in the restaurant-rich tourist industry in Central Florida. He cooked at every type of restaurant “from Chinese to American, Hooters to Boston Market, banquets to concert shows,” he said. “I like being around people and love being able to serve them.”

He had to put away the spatula when back surgery forced him off his feet. While he recovered, a friend suggested a job as a credit counselor. Sconiers knew he was in the right place the first day of training.

“I took one look at the training manual and it sounded like I wrote it,” he said. “As many jobs as I was in, I never made a killing as far as money goes. I was always trying to figure out how to make it work without tripping over and putting my family (wife and five children) in trouble.

“I call that the school of life. If you pay attention to what’s happening, and listen to what people say, you learn a lot about how to fix problems.”

Sconiers said it takes about five minutes and a few questions for him and clients to agree on the root cause of their financial problems.

“Not having a budget they can stick to is one problem,” he said, “and cell phones is right after that.

“Actually cell phones probably ought to be listed as the No. 1 problem because folks won’t do anything about it. They spend $120 to $150 a month for one phone. That’s crazy! And some families, they’re paying for three or four or five lines and you can’t talk them out of it.

“But a good budget, knowing how much you spend and how much you take in and getting all that in line, that’s something we can agree on.”

Ideally, Sconiers’ counseling is going to <a href=”https://staging.incharge.org/debt-management”>help clients consolidate bills</a>, eliminate late fees, maybe even lower interest rates on credit cards so they can pay off their debts faster. When that happens, Sconiers says he hears a completely different voice on the other end of the line.

“The tone changes,” Sconier said. “There is joy and anticipation of getting out of debt and starting all over again. It’s like happy days are here again! That’s the kind of voice I like to hear.”