Category:

Debt Relief

Bankruptcy doesn’t have to put an end to your dream of owning a home – it could happen as early as a year after bankruptcy discharge. The key is to …

If your debts have been discharged through bankruptcy and you are employed, you should have room in your monthly budget to contribute to a savings account. Set aside three months…

“I need a second chance!” That is bankruptcy in a nutshell. For whatever reason, your finances have gone sour, you’re drowning in debt, you’re sure you learned your lesson, so…

What Is Bankruptcy Debtor Education? In order to be discharged from Chapter 7 or Chapter 13 bankruptcy, you must complete a Pre-Discharge Debtor Education course. The purpose of this bankruptcy…

Harsh as its consequences are, bankruptcy also provides a financial fresh start. One way to get going (we are not making this up): Buy a car. Bankruptcy filings can be…

Credit counseling is a vastly under-tapped resource for people crippled by debt. A credit counselor’s goal is to educate consumers about the cause of their debt and offer solutions that…

Money woes plague countless millions of Americans, stressing marriages and giving rise to feelings of hopelessness. For many mired in debt, credit counseling offers a lifeline to solvency and better…

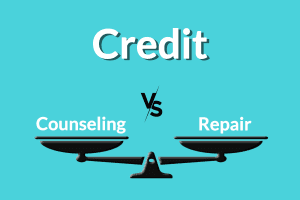

Good credit means better interest rates on homes, cars and credit cards, lower insurance rates, easier access to rental apartments and utilities and maybe even better job opportunities. Consumers with…

There are two terms that consumers with blemished credit reports should be careful with: credit repair and credit counseling. Credit repair companies are to finances what car repair is to…

Surviving paycheck-to-paycheck in America is simultaneously commonplace and scary. But this doesn’t mean people just scraping by can’t overcome the debt that threatens to swamp them. All it takes is…